- Home

-

- The entrepreneurial Journey: Navigating the Path to Success

-

- Test Your Price Model

Test Your Price Model

What's the right price

In the ever-evolving landscape of technology products, setting the right price can make or break a business.

The wrong pricing model can lead to disastrous consequences, ranging from missed revenue opportunities to customer dissatisfaction.

This lesson delves deep into the intricacies of pricing strategies, particularly for tech products.

Real-life examples will illuminate the impact of incorrect pricing, while detailed exploration of pricing models like freemium, subscription, advertising, and in-app purchases will provide valuable insights into revenue streams and cost considerations.

Additionally, we’ll highlight the significance of projections in assessing financial impacts, considering factors such as churn rate, volume, and pricing.

Entrepreneur's Toolkit: Turn Your Idea into a Successful Product

Prior to commencing the initial lesson of this course, it is of paramount importance that, as entrepreneurs, we initiate the process by downloading your toolkit.

For this course, the fundamental versions of the compelling apps are available at no cost.

These applications are exceptionally beneficial, as they will be employed to concentrate on developing your business idea throughout the entire duration of the course.

The Pitfalls of Incorrect Pricing

Imagine launching a cutting-edge tech product, only to find it languishing due to an ill-conceived pricing strategy.

This scenario is not uncommon, as exemplified by Microsoft’s Windows Vista.

The product’s premium pricing didn’t align with its perceived value, leading to disappointing sales and negative customer feedback.

Such examples underscore the crucial nature of accurate pricing, especially for tech products.

Exploring Main Price Strategies

In the ever-evolving landscape of the digital marketplace, selecting the right pricing strategy is akin to navigating a complex labyrinth. For entrepreneurs, especially those at the helm of small businesses or launching novel products, this choice is nothing short of pivotal. The price strategy you choose can significantly impact your product’s success, market penetration, and revenue generation potential.

In this chapter, we embark on a journey to explore the primary pricing strategies that entrepreneurs can harness to their advantage.

We will dissect each strategy, revealing its intricacies, and provide concrete insights into how these strategies can be employed effectively.

Our aim is to equip you, the entrepreneur, with the knowledge and tools needed to define the right pricing strategy for your digital product.

😃🆓💼 Freemium Model

The freemium model, epitomized by software like Dropbox and Spotify, offers a basic version of the product for free while charging for advanced features or premium services.

This strategy capitalizes on a large user base, converting a fraction into paying customers.

While this model fosters user engagement and loyalty, optimizing the conversion rate is paramount to revenue success.

To minimize costs, businesses must efficiently manage server resources and customer support for both free and paid users.

Maximizing revenue involves crafting irresistible premium features and implementing effective conversion strategies, potentially through limited-time offers or personalized recommendations.

💼🔐🔄 Subscription Model

The subscription pricing strategy is a shrewd approach that entails providing access to a product exclusively through a periodic subscription, such as monthly or annually.

This approach proves particularly advantageous for products that involve ongoing development and maintenance costs, such as applications or online services.

However, its merits don’t stop there; it also emerges as a potent strategy for products that require regular updates, as the subscription model allows for continuous product development funding.

A notable example of this strategy in action is Netflix.

This video streaming platform has made the monthly subscription its flagship offering for accessing its vast library of movies and TV series. In 2021, Netflix reached 209.18 million subscribers worldwide, generating revenue of $25 billion. These numbers demonstrate how effective the subscription pricing strategy can be when applied appropriately.

Our Tips 🚀

🔄💎🔗This approach demands providing consistent value to retain subscribers while continually adding new features to entice potential customers.

📉💰🛠️To reduce costs, optimizing server infrastructure and scaling efficiently are crucial. Maximizing revenue entails crafting tiered subscription plans catering to various user needs.

💰📅📈Offering annual subscriptions can also boost cash flow while providing incentives like discounts or exclusive content.

📢🤝📈 Advertising Model

The advertising-based pricing strategy revolves around offering a product for free and funding it through advertising. This strategy can be effectively employed for digital products with a broad audience reach, such as mobile apps or websites. Furthermore, it proves to be a potent approach for monetizing products that might otherwise be challenging to sell, such as educational or health-related apps.

A prime example of the successful implementation of the advertising-based pricing strategy is Instagram. This free-to-use social network generates revenue by displaying advertisements to users, typically tailored to users’ interests. In 2021, Instagram generated over $20 billion in revenue, underscoring the profitability of the advertising-based pricing strategy for digital products.

This strategy not only offers accessibility to a wide user base but also leverages the power of targeted advertising to create a win-win scenario for both users and advertisers. Users get to enjoy a free product while advertisers gain access to a highly engaged audience.

Our Tips 🚀

🎯📢🚫Balancing user experience with ad placements is vital, as intrusive ads can drive users away.

📉💰🎯To minimize costs, efficient ad targeting and streamlined ad delivery systems are essential.

💰📊📈Maximizing revenue involves attracting advertisers through user data insights and engagement metrics.

🚀🤝💼Leveraging native advertising and strategic partnerships can further enhance profitability.

📱💳🎮 In-App Purchase Model

The in-app purchase pricing strategy involves providing a product for free or at a reduced price, with the option to purchase additional features or content within the application. This approach can be employed to monetize products that require constant usage, such as mobile games, as well as to offer premium paid features for useful apps or productivity tools.

A compelling illustration of the success of the in-app purchase pricing strategy can be found in the case of Clash of Clans, a mobile game that offers users the opportunity to buy gems, gold, and elixir within the app. In the year 2020, Clash of Clans amassed a staggering revenue exceeding 700 million dollars, underscoring the remarkable effectiveness of this pricing strategy for digital products.

This strategy fundamentally hinges on the concept of providing users with a taste of what the application offers without imposing an initial financial barrier. By doing so, it not only attracts a broader user base but also entices them to invest in enhancing their experience within the app. This, in turn, fosters greater engagement and customer loyalty.

Furthermore, the in-app purchase model is incredibly versatile, as it caters to both entertainment and utility apps. For instance, gaming apps leverage it to offer power-ups, character customizations, and virtual currencies, while productivity apps may grant access to advanced features or ad-free experiences for a nominal fee.

In essence, the in-app purchase pricing strategy has proven to be a potent tool in the digital product monetization toolkit, capitalizing on user engagement and providing a sustainable revenue stream for developers and businesses alike. As technology continues to advance and user preferences evolve, it remains a strategy worth considering for those seeking to thrive in the digital marketplace.

Our Tips 🚀

🎨🚫🙅♂️Careful design is crucial to avoid alienating non-paying users.

📉💼📊To minimize costs, optimizing in-app purchase infrastructure and minimizing transaction fees is vital.

✨🛒Maximizing revenue involves creating enticing virtual goods and ensuring a seamless purchase process.

🕒🎁🎯Limited-time offers and personalized recommendations can drive conversions.

Take another step in your journey 🛣️

Write down your first revenue stream 🚀

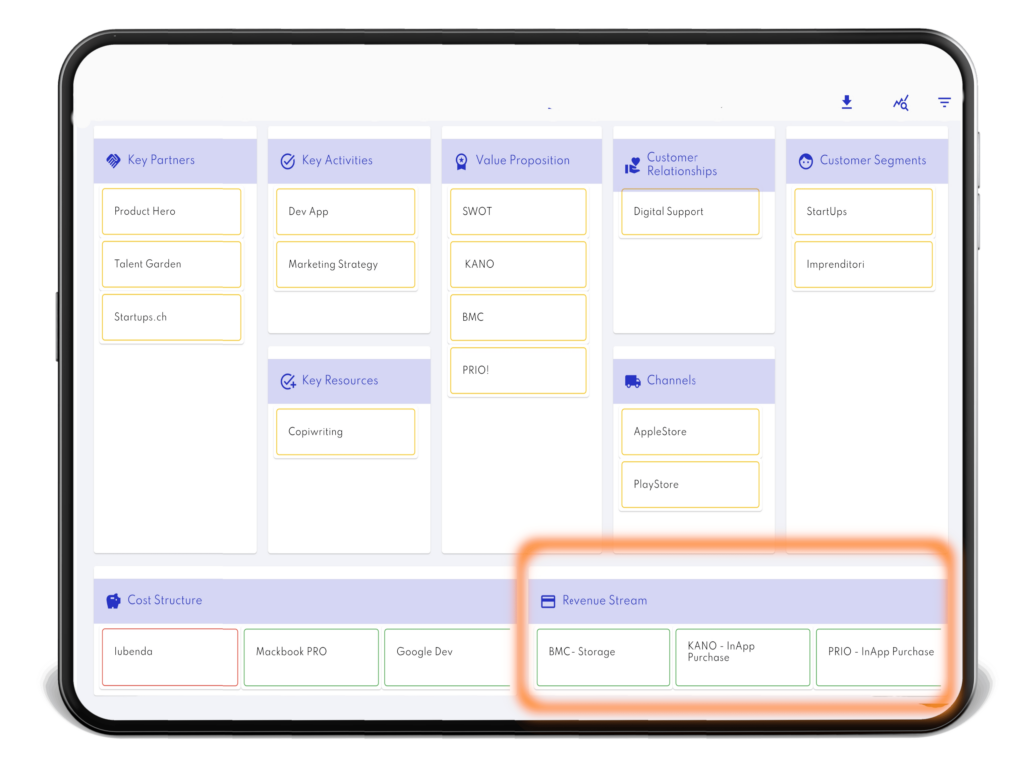

Optimize and refine your Business Model Canvas (BMC) by laying the groundwork for your very first revenue stream.

It’s as easy as clicking on the ‘Revenue Stream’ section, where you can input the name of your product item and offer a potential description to give it context and clarity.

Following this initial step, you’ll come across the ‘Revenue Type‘ section, a crucial aspect of your BMC.

Within the ‘Revenue Type’ section, you gain the ability to choose from among the four main pricing models that will shape how your product generates income.

This decision is a pivotal one, as it will define the financial strategy underpinning your business model and pave the way for your revenue streams to flourish.

Crafting the perfect pricing strategy is akin to composing a symphony of numbers and variables, and within each pricing model lies a unique configuration waiting to be mastered. To embark on this enlightening journey and configure your pricing strategies effectively, let’s delve deeper into the metrics that will be your guiding stars. Plus, we’ll add a touch of emoticons to make it all the more engaging! 🚀🎯💰

💳Subscription Strategy: Begin by orchestrating your subscription strategy. Set the stage with the right price, choose the frequency that resonates with your audience, and estimate the penetration rate. 🎟️💵📊

📱In-App Mastery: Next, step into the realm of in-app pricing. Tweak the price, consider the average number of monthly purchases your users might make (#avg purchase per month), and estimate the penetration rate. 📲💳🛒

📬 Direct Approach: For those who prefer a direct path, define your price and penetration strategy, and be ready to see your business flourish. 🎯💼📈

📺 Advertising Brilliance: If your path involves advertising, carefully select the price, anticipate the average number of minutes per month (#avg minutes per month), and estimate the penetration rate. 📈📢📊

But wait, there’s more! The adventure doesn’t stop here. You can bring your pricing strategy to life by configuring and experimenting with these metrics. To get started, click below and enter the fascinating world of pricing strategy creation! 🎶🔧🎉

Mixed Pricing Strategies & MVP

The selection of the right pricing strategy is pivotal to the success of a digital product, especially for small businesses or new ventures.

However, in certain situations, choosing a single pricing strategy that functions optimally for the specific product can be a challenging endeavor. In such cases, the adoption of a mixed pricing strategy can emerge as a highly effective solution, reducing inherent risks and facilitating comprehensive market testing.

In this insightful section, we will delve into how mixed pricing strategies can significantly benefit small businesses and new products, and explore how the integration of MVP (Minimum Viable Product) seamlessly complements these strategies.

🧐📊🚀 Defining the MVP

An MVP, or Minimum Viable Product, constitutes a scaled-down and simplified version of a digital product, encompassing only the essential features necessary to fulfill customer needs.

The primary objective behind introducing an MVP into the market is to rigorously test the core concept of the product, actively collect invaluable customer feedback, and implement vital modifications prior to committing substantial resources to the full-scale product development.

By utilizing an MVP, the risk and cost of development are notably mitigated, given that it allows for market testing with minimal initial investment.

🌟🎉💼 Mixed Pricing Strategies Unveiled

Mixed pricing strategies, as their name suggests, amalgamate two or more pricing approaches to efficiently cater to the diverse needs and preferences of customers.

These strategies are often strategically employed by small businesses and new product launches due to their inherent ability to reduce the financial risks associated with initial investment, allowing cost-effective market exploration of novel ideas.

Some key mixed pricing strategies include:

🚀💲📈Launch Price with Subscription: This approach involves launching a product at a promotional price for a limited period, accompanied by a long-term subscription option. This strategy effectively entices customers during the initial phase and encourages them to consider a long-term subscription.

A prime example is Adobe Creative Cloud, which offered a promotional price for the first year of usage alongside a long-term subscription option.

🆓💳🎮Freemium with In-App Purchase: This strategy entails offering a free version of the product with limited functionalities, while providing in-app purchase options to unlock additional features.

It proves effective in drawing in customers at the outset and incentivizing them to invest in additional functionalities.

The mobile game Clash of Clans is a testament to this approach, offering a free version with limited features, complemented by in-app purchase options for acquiring in-game currency and additional features.

💼🔒📆Fixed Price with Subscription Access: This pricing strategy provides the product at a fixed price, coupled with a subscription option for ongoing access to product functionalities.

It particularly suits products that demand continuous usage, such as accounting software or web hosting services.

QuickBooks accounting software, for instance, employs this strategy by offering the software at a fixed price alongside a subscription option for continuous access to features.

🎯👥💲Segmented Customer Pricing: This strategy involves differentiating the product’s price for specific customer segments based on their unique needs and the value the product offers to them.

It proves effective in aligning the price with the specific requirements of customers, thereby enhancing product profitability.

Spotify, the music streaming service, is a prime example, offering segmented pricing for students, families, and groups based on their distinct needs and perceived value.

⬆️⬇️💰Demand-Based Variable Pricing: This approach entails adjusting the product’s price according to market demand, increasing prices during periods of high demand and lowering them during periods of low demand.

This dynamic strategy effectively maximizes product profitability and adapts to market demand fluctuations.

Uber, the ride-sharing service, exemplifies this approach by raising prices during peak hours or events to incentivize more drivers to join and meet market demand.

🤝💡🚀 MVP and Mixed Pricing Strategies: A Symbiotic Relationship

The seamless integration of MVP and mixed pricing strategies is rooted in their shared ability to test products in the market with minimal initial investments. 🤝💼💡

Employing an MVP significantly reduces both the risk and cost associated with development by allowing products to undergo testing with a lean budget. 💰📊🧰 Meanwhile, mixed pricing strategies enable the examination of diverse pricing approaches in the market, thereby facilitating dynamic price adjustments to meet customer needs. 🔄📈🔍

Moreover, the utilization of an MVP and mixed pricing strategies collectively empowers businesses to acquire valuable customer feedback and make necessary refinements before committing substantial resources to product development. 📣🛠️📝

For instance, envision a small business developing a mobile application for daily task management. They could employ an MVP to assess the fundamental concept of the application in the market. 📱📋👥 Subsequently, they might implement a mixed pricing strategy, combining a freemium model with in-app purchases to incentivize the acquisition of additional features, complemented by segmented pricing tailored to specific customer segments based on their unique needs and perceived value. 🆓💳🎯 This holistic approach would enable the business to efficiently test the application in the market with minimal financial outlay while dynamically adjusting prices based on customer feedback. 📈🔄💰

Another scenario could involve a small business endeavoring to create a novel project management software. Initially, they could employ an MVP to rigorously test the core idea of the software in the market. 🚀📊📆 Subsequently, they might implement a mixed pricing strategy, incorporating a fixed price with a subscription model for continuous access to software features, alongside segmented pricing to cater to diverse customer requirements and perceived value. 💼🔒🎉 This comprehensive strategy would allow the business to efficiently test the software in the market with minimal financial exposure while staying responsive to customer feedback. 🔄📈📣

In both cases, the harmonious employment of an MVP and mixed pricing strategies enables small businesses to systematically test their product ideas in the market, effectively adapt pricing to customer needs, and substantially reduce the risks and costs associated with development. 💪📉💼 This dynamic synergy ultimately empowers businesses to maximize product profitability while ensuring they deliver solutions that genuinely resonate with their target audience. 🚀💡👥

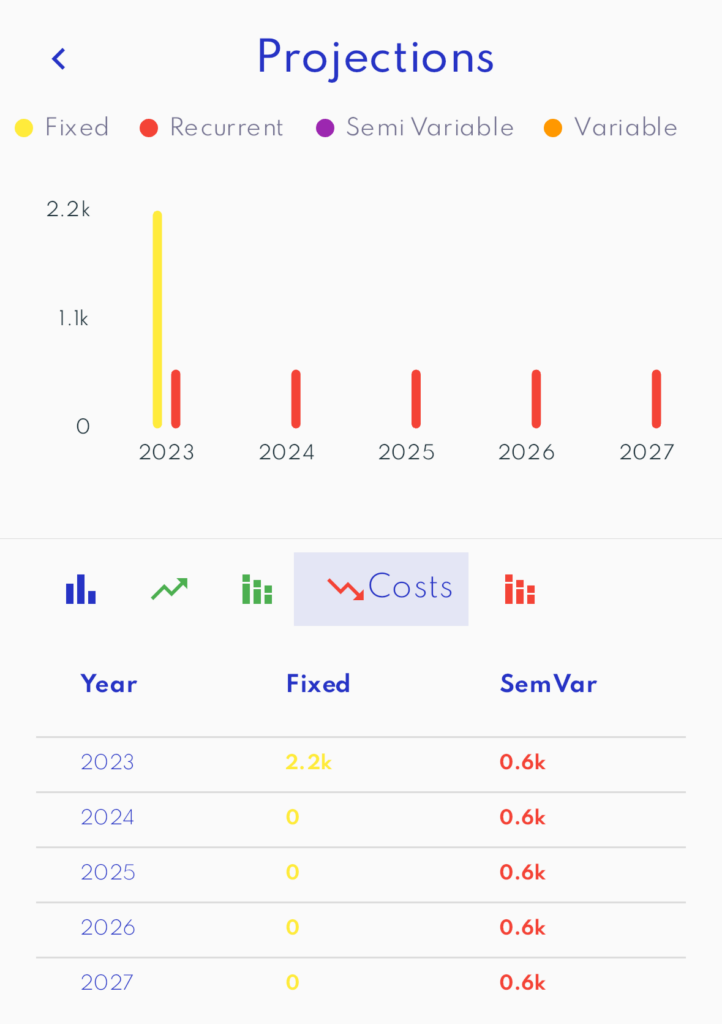

How to Utilize the Business Model Canvas for Projecting Your Idea's Potential

To unearth the full spectrum of an idea’s potential, one must harness the formidable tool of economic projections. 🚀 Within our BMC app, you’ll stumble upon a dedicated section that empowers you to unlock the transformative potential of projecting your idea’s financial trajectory over the next five years.

Place your emphasis on the pivotal aspects: attaining equilibrium ⚖️, reaching the break-even milestone 💰, strategically distributing your budget 💡, crafting a diversified revenue stream 💰🌊, and comprehending the critical role of Key Performance Indicators (KPIs) 🔍 linked to various pricing models.

Furthermore, we’ll delve deep into dissecting cost streams 💸 and devising strategic approaches 🛠️ to optimize them, ultimately aiming to amplify your financial outcomes. 📈✨

The Art of Balance: Achieving Break-Even

Your Financial North Star 🌟

In the captivating journey of your idea’s economic landscape, there exists a shining star – the elusive break-even point. This pivotal juncture is akin to discovering buried treasure 🏴☠️ in the vast sea of entrepreneurship. Picture it as the precise moment when your revenues seamlessly align with your expenses, illuminating the path to financial sustainability. 🌊📈

Understanding the exact timing of this breakthrough is akin to having a compass that guides your every financial decision. It’s not just a milestone; it’s a beacon that ensures you’re on the right course, heading towards profitability. 🚢

Budget Allocation: A Delicate Balancing Act ⚖️

The break-even point isn’t a mere abstract notion; it’s a tangible financial turning point 🔄. It’s the instant your venture begins its ascent towards profitability. Armed with this invaluable knowledge, you can engage in the delicate art of budget allocation. This is where you distribute your resources strategically, ensuring you have the financial fortitude to reach and surpass the break-even stage. 💡💰

For instance, imagine you’re embarking on a journey to climb Mount Everest. You wouldn’t set off without the right gear, supplies, and a plan, right? Similarly, knowing when you’ll hit the break-even point equips you with the foresight to allocate your budget effectively, ensuring that you have all the resources necessary to conquer your entrepreneurial summit. 🏔️💼

Now, let’s dive deeper into the financial sea and explore how economic projections can help you navigate your idea’s course with confidence. 🚀🌊

The Revenue Stream Composition: More Than Just Income

Crafting Your Financial Symphony 🎶

Revenue, my fellow entrepreneur, is not a monolithic concept. It’s a magnificent symphony, a harmonious blend of diverse notes, each contributing to the crescendo of your financial success. 🎻💰

You see, your income isn’t just a final figure; it’s a complex composition of how you generate that income. It’s an orchestra of various pricing models, each playing its distinct tune in your grand financial opera. 🎼🌟

Advertising Revenue: The Prelude 📢

Imagine advertising revenue as the prelude to your masterpiece. It sets the stage, entices the audience, and adds a touch of anticipation. 🎬 With strategic ad placements and efficient ad targeting, it can strike the perfect note, harmonizing user experience with financial gain. 🤝💼

For instance, think of Instagram 📸, where ads seamlessly blend with user content, creating a win-win scenario for both users and advertisers. This revenue stream is your opening act, drawing in the crowd. 🤳🤑

Subscription Revenue: The Ongoing Sonata 🎵

Now, let’s introduce the ongoing sonata – subscription revenue. 📅🎶 This pricing model thrives on consistency and loyalty. It’s like a subscription to your favorite magazine 📰 or streaming service 📺, where users commit to regular payments for premium access.

Consider Netflix 🍿, a prime example of how the subscription model can transform a business. In 2021, it amassed over 209 million subscribers worldwide, generating a staggering $25 billion in revenue. This model keeps your audience engaged, paying for continuous value. 🌐🤩

Direct Payment Revenue: The Bold Crescendo 📈

Direct payments are your bold crescendo. 💥 It’s the moment where users make a conscious choice to pay for your product or service outright. It’s like purchasing a piece of art 🖼️ or buying a software license 💻.

This model allows you to set the price and reap immediate rewards. It’s akin to walking into a store and making a purchase. 🛍️ Your customers directly invest in what you offer, adding a powerful dynamic to your financial composition.

In-App Purchase Revenue: The Enchanting Refrain 📱✨

In-app purchases are the enchanting refrain in your symphony. They offer users a taste of your product without imposing a significant upfront cost. This flexible model is versatile, catering to both entertainment and utility apps. 🎮📊

Consider Clash of Clans 🏰, the mobile game that lets users buy in-game items. In 2020, it raked in over $700 million in revenue. This approach entices a broader user base and encourages them to enhance their experience within the app. It’s the art of selling virtual goods in a captivating way. 💎🕹️

5. Penetration as the Pivot Point: Shaping the Symphony 🎚️

Now, let’s shift our attention to the conductor’s podium – penetration. 🎤

This parameter allows you to fine-tune your masterpiece.

It dictates the percentage of potential users who will become paying customers. Think of it as the volume control of your financial symphony. 🎛️

You can adjust this lever to see how different levels of market adoption impact your projections, break-even point, and revenue. 📈📊

It’s your tool to orchestrate the crescendo of success.

Now, as we continue our symphonic exploration of economic projections, let’s delve into the realm of cost streams 🌊 and discover strategies to perfect your entrepreneurial masterpiece. 🎨💼

The Cost Stream: Navigating Financial Waters

Sailing to Success 🚢💰

Let’s set sail on the financial seas and navigate through the intricate cost stream. Just as a captain charts the course for a successful voyage, you must chart your financial path, understanding the nuances of your cost structure. 🗺️💼

Fixed Costs: Anchoring Your Finances ⚓

Fixed costs are the steady anchor in your financial journey. They are the expenses that remain constant, regardless of your level of business activity. Think of them as the unwavering lighthouse guiding your way through stormy seas. 🌧️🏮

Examples of fixed costs include rent, salaries, and insurance premiums. These are essential expenditures that keep your ship afloat, regardless of how many passengers come aboard. 🏢👩💼🌟

Variable Costs: Navigating the Tides 🌊

Variable costs are like the unpredictable tides of the sea. They fluctuate with your level of production or sales. Picture them as the rising and falling waves that your ship must gracefully navigate. 🌊🚢

For instance, the cost of raw materials for manufacturing or the expenses tied to your sales and marketing efforts are variable costs. They ebb and flow as your business activity surges and recedes. 📦💻💨

Semi-Variable Costs: Adapting to the Winds of Change 🌬️

Semi-variable costs are a bit like the shifting winds at sea. They contain both fixed and variable components. These costs provide some flexibility, allowing you to adjust your sails as needed. 🌬️⛵

Consider a salary structure that includes a base salary (fixed) and commissions based on sales (variable). This hybrid nature enables you to adapt to changing conditions, much like a sailor adjusting their course to follow the wind. 💨💼🌅

Recurrent Costs: Riding the Waves of Routine 🔄

Recurrent costs are the steady rhythm of your financial journey. They are periodic expenses that repeat at set intervals, much like the predictable rhythm of the ocean’s waves. 🌊🔄

Think of monthly subscription fees or annual software licenses. These costs occur regularly and can be planned for in advance. They create a sense of stability in your financial voyage, akin to the reliability of the tides. 🌊📆💻

Strategies to Decrease Costs and Optimize KPIs: Sailing to Efficiency 🛠️💡

Now, let’s hoist our entrepreneurial flags high and explore strategies to navigate these financial waters effectively. 🚩

Automation: Automate repetitive tasks to reduce labor costs and enhance efficiency. It’s like having a crew of robots to handle routine chores aboard your financial ship. 🤖🔧

Outsourcing: Consider outsourcing non-core functions to specialized experts. Think of it as inviting seasoned sailors from other ships to join your crew and navigate specific tasks more effectively. 🚢👨💼

Contract Renegotiation: Review existing contracts and negotiate for better terms. It’s akin to bartering with fellow seafarers to secure favorable trade agreements. ⚖️🤝

KPI Focus: Keep a close eye on your Key Performance Indicators (KPIs). If you notice a discrepancy between projected and actual results, adjust your course accordingly. For instance, if advertising revenue isn’t meeting expectations, explore ways to enhance user engagement to stay on course. 📊🧭🎯

Remember, just as a seasoned captain knows when to trim the sails and adapt to changing conditions at sea, you must be agile and proactive in managing your cost stream.

By doing so, you’ll navigate toward financial success, just like a skilled mariner conquering the open ocean. 🌊🌅⚓

0€

Free contentThe entrepreneurial Journey

Throughout this course, you'll explore:

The effective use of BMC and SWOT to validate your business idea.

Revealing insights into your competitors and their hidden strategies.

Leveraging their weaknesses through appropriate business tactics.

Ultimately, identifying the optimal pricing strategy for your product.

300€

ONE2ONE - SINGLE LESSONDo you have a particular lesson in mind that you'd like to revisit, customized to your specific business situation?

Take advantage of our complimentary 20-minute phone consultation, during which you can share your BMC and SWOT analysis from the lessons.

We'll then arrange a personalized one-on-one session just for you.

1600€

ONE2ONE 7 LESSONSLooking to fortify your business case?

Share all the BMC and SWOT analyses you've developed during the course.

Seize the opportunity of our free 20-minute phone consultation, where you can discuss your primary objectives.

Following that, we'll organize seven one-on-one sessions to collaborate on refining your concept and taking it to the next level.